Mobile |

Online Banking |

Accounts by Phone |

Savings |

Checking |

Youth Accounts |

|

|

Direct Deposit & Automatic Withdrawals

|

Home Loans |

Auto Loans |

Credit Cards |

Personal Loans |

Student Loans |

|

Protect Your Investment

|

|

Apply in 3 Steps

Already an SLFCU Member?

Log In to Online Banking

Please log in using your online banking credentials. Select More > More.. > Quick Apply to begin your application. If you'd like to continue with your application without logging in, click here to apply.

If you are currently not enrolled for online banking, visit slfcu.org/OnlineBanking or call 505.293.0500 or 800.947.5328 to enroll.

Non-Members

Apply for SLFCU Membership and/or a Loan Below:

Become a member to receive smart financial products with outstanding personal service from an organization you can trust.

Important Information About Procedures for Opening a New Account

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. What this means for you: When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license or other identifying documents.

Apply in 3 Steps

Already an SLFCU Member?

Log In to Online Banking

Please log in using your online banking credentials. Select More > More.. > Quick Apply to begin your application. If you'd like to continue with your application without logging in, click here to apply.

If you are currently not enrolled for online banking, visit slfcu.org/OnlineBanking or call 505.293.0500 or 800.947.5328 to enroll.

Non-Members

Apply for SLFCU Membership and/or a Loan Below:

Become a member to receive smart financial products with outstanding personal service from an organization you can trust.

Important Information About Procedures for Opening a New Account

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. What this means for you: When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license or other identifying documents.

Apply in 3 Steps

Already an SLFCU Member?

Log In to Online Banking

Please log in using your online banking credentials. Select More > More.. > Quick Apply to begin your application. If you'd like to continue with your application without logging in, click here to apply.

If you are currently not enrolled for online banking, visit slfcu.org/OnlineBanking or call 505.293.0500 or 800.947.5328 to enroll.

Non-Members

Apply for SLFCU Membership and/or a Loan Below:

Become a member to receive smart financial products with outstanding personal service from an organization you can trust.

Important Information About Procedures for Opening a New Account

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. What this means for you: When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license or other identifying documents.

Investment & Retirement Services |

Investment & Retirement Products |

Insurance |

Additional Services |

Calendar |

Branches |

Special Offers & Discounts |

|

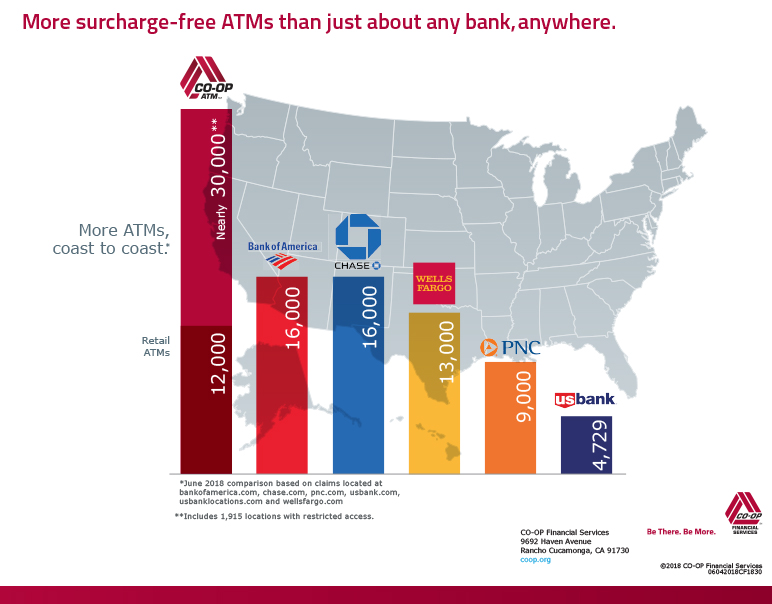

SLFCU’s free checking accounts come with a complimentary no-fee Mastercard® debit card. You can use it to make purchases anywhere Mastercard is accepted and withdraw cash at more than 30,000 surcharge-free ATMs nationwide.

SLFCU’s free checking accounts come with a complimentary no-fee Mastercard® debit card. You can use it to make purchases anywhere Mastercard is accepted and withdraw cash at more than 30,000 surcharge-free ATMs nationwide.