Online Banking Budgeting and Savings Tools

System Provides Budgeting and Savings Tools

SLFCU’s online banking gives you access to tools that can help you build a monthly budget, automatically categorize transactions into budget categories, and create and track savings goals.

Categorize Transactions and Build a Budget to Manage Your Spending

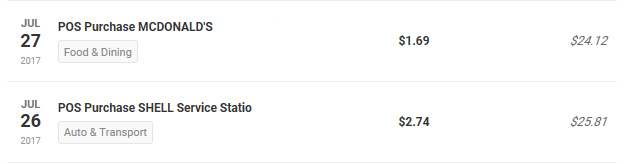

As you spend and earn money, some of your transactions are categorized automatically inside online banking. For instance, purchases at a grocery store would be categorized as “Groceries” or purchases at a gas station would be labeled “Auto & Transport.” You can change the categories that have been automatically assigned, assign uncategorized transactions, split transactions between multiple categories, and create new categories to meet your needs.

Transactions can be labeled with a category such as Food & Dining or Auto & Transport.

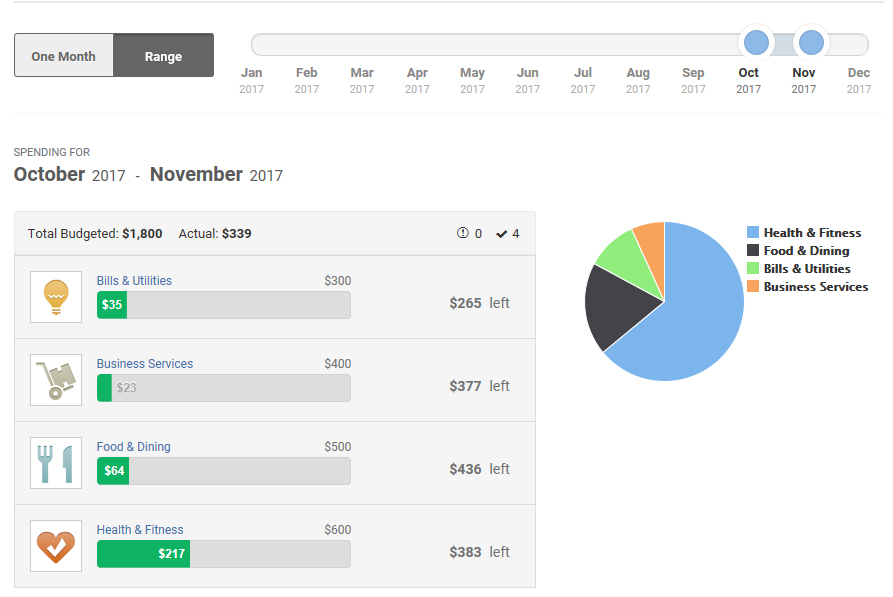

It takes just a few additional steps to build a monthly budget based on your categorized spending and income. You can set a monthly income target as well as monthly spending targets for specific categories (such as groceries, utilities, dining out, etc.). The system tracks your spending and income versus those targets. You can also opt to receive alerts letting you know you’ve exceeded your spending limit(s).

An overview of a monthly budget will show how much has been spent in categories such as Food & Dining or Health & Fitness.

Create Savings Goals to Help Stay on Track

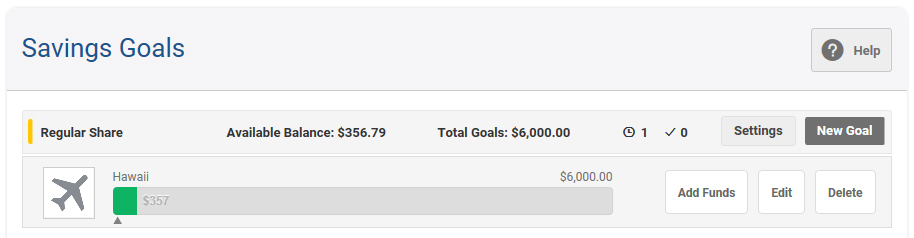

What’s the next step after building a monthly budget? How about saving for a dream purchase? In the Savings Goals area of online banking you can create savings goals and connect them to a designated savings account. Determine how much money you want to save and set a target date. Then you can view details on how much money you need to save each month to reach your goal, and track your progress toward reaching it.

Create goals connected to savings accounts to track progress.

If you’d like to open additional savings accounts to track goals separately, it’s easy to do so online or by visiting any branch. There is no cost to open additional savings accounts.

Budgeting and Savings Help When You Need It

Online banking makes it easier to create and track budgets and goals. SLFCU also offers additional financial tools, including a variety of free seminars, articles, and in-person help any time you visit a branch.

« Return to "View All Articles"