Power Money Market Account

Earn up to 3.04% APY2 – PLUS get a cash back bonus for a limited time!

With a Power Money Market Account, you’ll get our highest yield on your lowest deposit amount. Kick-start your earnings potential today, no matter how much you start with – and enjoy easy access to your funds whenever you need them, with no service fees or penalties for withdrawals. The power is in your hands to maximize your earnings, whether it’s to build an emergency fund, save up for a big purchase, or boost your retirement savings.

With a Power Money Market Account, you’ll get our highest yield on your lowest deposit amount. Kick-start your earnings potential today, no matter how much you start with – and enjoy easy access to your funds whenever you need them, with no service fees or penalties for withdrawals. The power is in your hands to maximize your earnings, whether it’s to build an emergency fund, save up for a big purchase, or boost your retirement savings.

Use your tax refund to earn up to 2.00% cash back when you make a new money deposit* to a new or existing Power Money Market Account!

POWER MONEY MARKET ACCOUNT CALCULATOR

Use our handy calculator to see how much you could earn in just one year.

| Deposit Distribution | Rate |

|---|---|

| $0.00 | 3.00% |

| $0.00 | 1.50% |

| $0.00 | 0.50% |

| $0.00 | 0.25% |

| $0.00 | 0.20% |

| $0.00 | 0.10% |

POWER MONEY MARKET ACCOUNT RATES

| Power Money Market Savings (w APY) | ||

| Effective Date: Thursday, April 18th, 2024 | ||

| Balance | Dividend Rate 1 | APY2 |

| $1.00 - $2,500.00 | 3.00% DR | 3.04% APY |

| $2,500.01 - $5,000.00 | 1.50% DR | 1.51% APY |

| $5,000.01 - $10,000.00 | 0.50% DR | 0.50% APY |

| $10,000.01 - $15,000.00 | 0.25% DR | 0.25% APY |

| $15,000.01 - $25,000.00 | 0.20% DR | 0.20% APY |

| $25,000.01 and over | 0.10% DR | 0.10% APY |

1Dividend rate and APY may change at the discretion of the Board of Directors.

2Annual Percentage Yield (APY) if dividends are not withdrawn during this term. Share accounts are federally insured to at least $250,000 by the National Credit Union Administration (NCUA), an agency of the US Government. Yields are determined at the time of investment. A savings account establishing membership with a $5 minimum deposit is required.

*New money is required and is considered those new-to-SLFCU funds which are: (1) received directly into the Power Money Market Account via cash deposit or via check, ACH, and/or wire deposit of funds drawn from another financial institution; or (2) received directly into another share account under the same master account as the Power Money Market Account via cash deposit or via check, ACH, and/or wire deposit of funds drawn from another financial institution and then transferred into the Power Money Market Account within five days. One-time cash back bonus will be awarded 180 days after initial qualifying deposit(s) of new money and is calculated based on an average daily balance of new money deposit(s) over a 180 day period, as follows: 1.00% cash bonus award for $0.01 - $5,000, 1.50% cash bonus award for $5,000.01 - $10,000 and 2.00% cash bonus award for $10,000.01 and up. Account must be in good standing at the time cash back is awarded. Cash back bonus is available to existing and new Power Money Market Account holders. SLFCU reserves the right to end or modify this cash back bonus award at any time. Tax implications may apply to awarded bonus.

ANSWERS TO FREQUENTLY ASKED QUESTIONS

Expand All Sections close all sections

The Power Money Market Account is a new SLFCU product that offers its highest dividend rate, or APY*, on the lowest amount deposited, up to $2,500. Funds deposited above that amount earn lower rates that are applied in tiers. Rates for each tier are blended into a single rate that applies across the entire deposit amount. No matter how much you deposit, you’ll enjoy a higher rate than with a traditional savings account.

Unlike traditional money market accounts, which earn higher rates on higher balances, the Power Money Market Account offers higher rates on lower balances. This is called a “reverse-tier” type of account.

The Power Money Market Account is a smart choice to kick-start a savings habit as it offers the return of a high-earning APY without the need for a high deposit balance, and with the liquidity of a regular savings account.

*Annual Percentage Yield

Current SLFCU members can apply for a Power Money Market Account online here, from within online or mobile banking, by visiting a branch, or by calling 505.293.0500 or 800.947.5328.

Non-members are invited to apply for membership and open a Power Money Market Account. Membership eligibility requirements apply. Learn more about joining SLFCU.

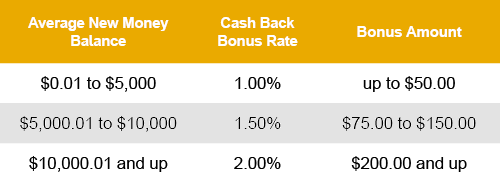

When you make a new money deposit* to a new or existing Power Money Market Account, you will receive a cash back bonus between 1.00% and 2.00% based upon the average daily balance of the new money over a 180-day period.

New money deposits between $0.01 and $5,000 will earn a 1.00% Cash Back Bonus. New money deposits between $5,000.01 and $10,000 will earn a 1.50% Cash Back Bonus. New money deposits of $10,000.01 and over will earn a 2.00% Cash Back Bonus. The bonus amount will be added to your account at the end of the 180-day period.

*New money is considered those new-to-SLFCU funds which are: (1) received directly into the Power Money Market Account via cash deposit or via check, ACH, and/or wire deposit of funds drawn from another financial institution; or (2) received directly into another share account under the same master account as the Power Money Market Account via cash deposit or via check, ACH, and/or wire deposit of funds drawn from another financial institution and then transferred into the Power Money Market Account within five days. Account must be in good standing at the time cash back is awarded.

Absolutely! You can apply for membership and a Power Money Market Account at the same time. Membership eligibility requirements apply. Learn more about joining SLFCU.

The Power Money Market Account is designed for anyone who wants a higher yield on their deposits while keeping their money available when they need it. It’s a great way to save up for an emergency fund, or to achieve a financial goal such as saving for a vacation or a down payment on a home.

Since lower deposit amounts earn the highest rates, and there is no minimum balance requirement, it’s easy for anyone to get started with a Power Money Market Account and see their deposit balance grow quickly. Members with little to no money in savings, and/or those who do not want to lock their funds in a certificate account, are also great candidates for this type of offering.

Existing SLFCU members can establish a Power Money Market Account with as little as $1. To open a new SLFCU membership and apply for a Power Money Market Account, a share savings account must also be established with as little as $5.

One Power Money Market Account can be opened per SLFCU member (based on their tax ID number).

The Power Money Market Account is not a temporary or “special” product. However, SLFCU may choose to change the rate and/or stop offering new accounts of this type at a future date due to rate /pricing environment changes or other considerations.

Absolutely! Apply for a Power Money Market Account online, from within online or mobile banking, by visiting a branch, or by calling 505.293.0500 or 800.947.5328.

Yes. You can make deposits to or withdraw funds from your Power Money Market Account anytime using your existing SLFCU debit card at an ATM. You can also transfer funds to the account from SLFCU savings, money market, and checking accounts.

Yes. Your Power Money Market Account can be assigned as overdraft protection.

No. Zelle is only used with checking account funds.

No. Only checking account funds can be used in the Pay Bills function in online and mobile banking.

No. The account cannot be used for payments made by swiping a debit card.

SLFCU is not offering the Power Money Market Account to business members at this time. We hope to offer a comparable type of product in the future.

No. SLFCU is not offering the option to convert existing SLFCU IRA Savings Accounts to Power Money Market Accounts.

Apply in 3 Steps

Already an SLFCU Member?

Log In to Online Banking

Please log in using your online banking credentials. Select More > More.. > Quick Apply to begin your application. If you'd like to continue with your application without logging in, click here to apply.

If you are currently not enrolled for online banking, visit slfcu.org/OnlineBanking or call 505.293.0500 or 800.947.5328 to enroll.

Non-Members

Apply for SLFCU Membership and/or a Loan Below:

Become a member to receive smart financial products with outstanding personal service from an organization you can trust.

Important Information About Procedures for Opening a New Account

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. What this means for you: When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license or other identifying documents.