Tax Season Help

Save On TurboTax® and H&R Block® This Tax Season

Whether you prefer to file on your own with TurboTax or get help from an H&R Block tax pro, as an SLFCU member you can save money while getting your biggest possible refund.

- TurboTax: Members get a bigger discount this tax season with savings of up to 20% on TurboTax federal products.1 Get Started

- Members get the best-in-market offer with savings of up to $25 on in-office tax prep services.2 Get Coupon

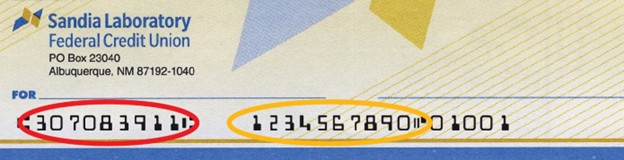

ROUTING NUMBER

SLFCU's routing number is 307083911.

TAXPAYER RESOURCES

- IRS Resources for Individual Taxpayers

- IRS Forms, Instructions & Publications

- IRS Free File

- IRS Form W-8BEN

- IRS Form W-9 (Rev. March 2024)

- Certification of Substantial Presence Form

- New Mexico Taxation & Revenue

- State of California Franchise Tax Board

IRA CONTRIBUTIONS FOR 2023 TAX YEAR

Make the most of your retirement savings by contributing the maximum yearly limit to your IRAs. For the 2023 tax year, you can contribute a total amount of $6,500 to traditional or Roth IRAs. If you are over age 50, you can contribute an additional $1,000 “catch-up” contribution for a total of $7,500.

IRA contributions for the 2023 tax year can be made until the tax filing deadline on April 15, 2024. Members with last-minute IRA contributions for tax year 2023 are asked to call SLFCU by April 15 at 3:30 p.m. MT to ensure adequate processing time. Most branches are open until 4:30 p.m. MT that day as well. Visit slfcu.org/Locations for hours.

If you don’t have an IRA, you can get started today at slfcu.org/IRAs. SLFCU offers traditional and Roth IRAs as well as Education Savings Accounts. Open your IRA account with as little as $5.

INVESTMENT OPTIONS FOR YOUR IRAs

If you’re looking for higher yield opportunities for your retirement savings, talk to a financial professional located at SLFCU. Learn more.

When setting up a direct deposit for your tax refund in SLFCU online or mobile banking, it’s important that the account number you use for direct deposit services is in a specific format. Please use the following information to set up your deposit:

SLFCU’s routing number: 307083911

To deposit your refund into a savings account, use the account number and the product ID for that account. For example, if your savings account number is 1234567, and you would like the deposit to go to your 0002 savings account, enter your account number as 12345670002.

To deposit your refund into a checking account, use the account number and the product ID for that account. To locate that number, select Accounts from the top menu bar in online banking and click on the checking account for which you’d like to set up the direct deposit. Then, select the Account Details tab and look for the “Auto WD & Direct Deposit #” option.

You can also use the number printed on the bottom of your checks as shown in the image below. The automatic withdrawal and direct deposit account numbers are in the yellow circle in the bottom middle of the check. Note: the last number string – 01001 – in the image is the number for that individual paper check and should not be included with the account number. SLFCU’s routing number is shown in the red circle.

IMPORTANT DETAILS ABOUT TAX REFUNDS

- When setting up a direct deposit for your tax return, specify if the account is savings or checking.

- All named recipients on the refund check must be owners or joint owners of the specified SLFCU account. A person who is not a joint owner of the account cannot deposit their refund check into your SLFCU account.

If you need help with your tax refund direct deposit, call us at 505.293.0500 or 800.947.5328.

1TurboTax Offer *Visit https://turbotax.intuit.com/lp/yoy/guarantees/ for TurboTax product guarantees and other important information. Limited time offer for TurboTax 2023. Savings are on TurboTax federal products only. Terms, conditions, features, availability, pricing, fees, service and support options subject to change without notice. Intuit, TurboTax and TurboTax Online, among others, are registered trademarks and/or service marks of Intuit Inc. in the United States and other countries. Other parties' trademarks or service marks are the property of their respective owners.

2H&R Block Offer Void if sold, purchased, or transferred and where prohibited. No cash value. Valid at participating U.S. offices only. A new client is an individual who did not use H&R Block or Block Advisors office services to prepare their 2022 tax return. Discount valid only with or for preparation of an original 2023 personal income tax return. Coupon must be presented prior to completion of initial tax interview. Discount may not be combined with any other offer or promotion. Expires October 15, 2024. OBTP#13696-BR ©2023 HRB Tax Group, Inc.

Go to main navigation